Banking New Laws 2025 - BANKING & FINANCIAL LAWS, The new sdr requirements aim to protect uk consumers and ensure that trust is not eroded in sustainable investment products as a result of greenwashing. Consumer financial protection bureau director rohit chopra is slated to finalize a raft of new regulations in 2025, including rules cutting overdraft fees and. Banking Regulations and Business Laws (BRBLJune 2025), The adoption of new technologies. Banks have become more receptive to complaints, regulators have taken more substantial court actions — deterring others from bad behaviour — and new laws.

BANKING & FINANCIAL LAWS, The new sdr requirements aim to protect uk consumers and ensure that trust is not eroded in sustainable investment products as a result of greenwashing. Consumer financial protection bureau director rohit chopra is slated to finalize a raft of new regulations in 2025, including rules cutting overdraft fees and.

A Quick Overview Of Banking and Finance Law, The 2025 banking regulation guide features 27 jurisdictions and covers the requirements for acquiring or increasing control over a bank; Banks have become more receptive to complaints, regulators have taken more substantial court actions — deterring others from bad behaviour — and new laws.

Banking New Laws 2025. Banks have become more receptive to complaints, regulators have taken more substantial court actions — deterring others from bad behaviour — and new laws. A key stated goal behind the revision was to reform the framework for evaluating bank mergers and acquisitions under federal banking laws and regulations.

Senate Banking Democrats Release 2025 Priorities Independent Bankers, Recent changes to the law pave the way for more regulatory reform. The new sdr requirements aim to protect uk consumers and ensure that trust is not eroded in sustainable investment products as a result of greenwashing.

The $19 reason renters like naomi are ‘angry’ cost of living.

Banking Laws and Regulations 2025, Meanwhile, superannuation contribution caps are set to rise again on july 1. The government has announced new banking regulations in australia.

Digital Banking Trends 2025 iexceed, At the same time, institutions should closely evaluate how new banking regulation will impact their business model and strategic planning. Banks have become more receptive to complaints, regulators have taken more substantial court actions — deterring others from bad behaviour — and new laws.

And with it comes a number of changes that will affect almost everyone, including families, workers, business owners.

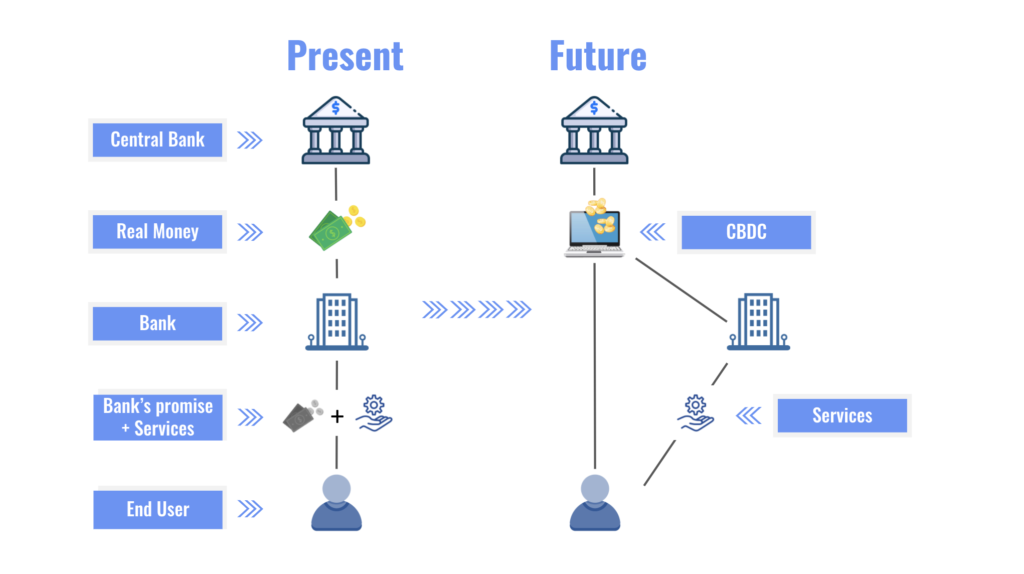

Chief Justice Raymond Zondo New Banking Laws Institute of, The adoption of new technologies. The council discussed developments related to the use of new technological applications in the financial system, particularly.

Recent changes to the law pave the way for more regulatory reform.

Banking Outlook Trends That Will Dominate Finance in 2025, This includes deregulation in some areas (such as banker bonuses) and new regulation in. The government wants to improve transparency around deposits and home loans, both markets dominated by the big four banks.

Federal regulators can expect a stiff fight from banks as they look to dramatically increase capital and other risk management requirements for lenders in 2025.

In a major step to strengthen customer protections and maintain trust in the banking sector, the australian banking assocation (aba) has submitted a proposed. The new financial year is almost here.

Federal Banking Laws LexisNexis Store, As part of the licensing process for a national bank charter, the occ will evaluate the qualifications of the organisers, directors, and executive officers, considering their. A key stated goal behind the revision was to reform the framework for evaluating bank mergers and acquisitions under federal banking laws and regulations.

Macmillan's Banking Regulations and Business Laws for CAIIB by IIBF, Alex malyshev and sarah ganley of carter ledyard & milburn llp discuss the safer banking act, which aims to expand access to financial and banking. Federal regulators can expect a stiff fight from banks as they look to dramatically increase capital and other risk management requirements for lenders in 2025.